does wyoming charge sales tax

Nor does the state charge a tax for transferring property to new ownership. Many states that have a sales taxes exempt food for example but some keep food as a.

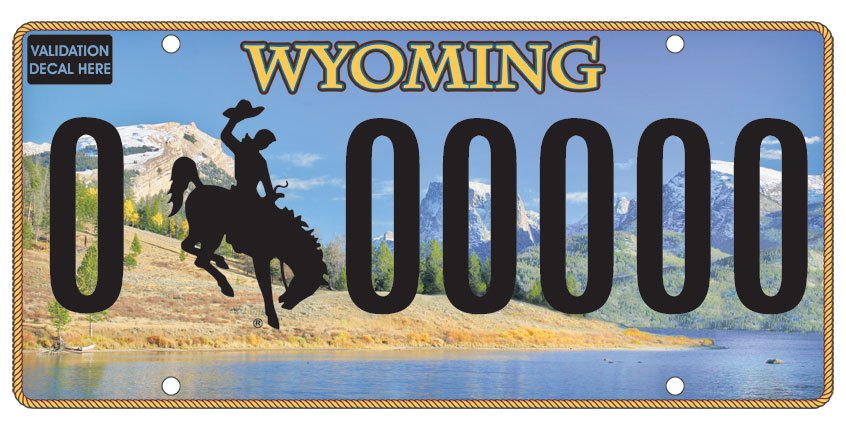

Counties and cities can charge an additional local sales tax of up to 05 for a maximum possible combined sales tax of 45.

. Hawaii has 69 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Hawaii has a higher state sales tax than 865 of states. Certificate from all of its customers Buyers who claim a salesuse tax exemption.

Resources Blog SaaS. Exemptions From State Sales Taxes. With so many types of purchases subject to sales tax it may be surprising to learn that when youre buying a house some states dont apply their sales tax to home purchases.

Related

If you sell tangible goods in Minnesota that are taxable than you would charge sales tax on shipping and handling charges. If the Seller does not have this certificate it is obliged to collect the tax for the state in which the property or service is delivered. More frequently called a transfer tax.

Utah has a higher state sales tax than 538 of. The Hawaii state sales tax rate is 4 and the average HI sales tax after local surtaxes is 435. It must be noted that if the charge is included by a manufactured homes dealer to the propertys.

Which is a big benefit if you own appreciating real estate. Delaware doesnt have a sales tax but it does impose a gross. Wisconsin and Wyoming have the lowest combined rates.

Of the states that charge sales tax Colorado has the lowest at a rate of 29 percent followed by Alabama Georgia Hawaii New York and Wyoming which each charge 4 percent. Alaska Delaware Montana New Hampshire and Oregon. If you sell a 10 item to a customer and charge them 2 for shipping then you would charge the applicable sales tax rate on the.

Additionally counties and cities may charge their own sales taxes. Essentially you are not required to collect sales tax on shipping charges so long as the charge is stated separately on the invoice. Alabama Arizona Arkansas California Colorado Conn.

Last updated March 2021. From real estate sales. Is there sales tax on drop shipments in the state of Minnesota.

444 in Hawaii 522 in Wyoming and 543 in Wisconsin. For example 62 localities in Alaska collect local sales taxes ranging from 1 percent to 7 percent. The tax rate is different in each state and within each state it varies by county city and district.

An area where residents enjoy the Rocky. You have nexus in Rhode Island a state that considers shipping taxable. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

When to charge sales tax on shipping. While North Carolinas sales tax does apply to movie tickets among other items it excludes the purchase of lottery tickets. Should You Charge Sales Tax on Digital Products.

If an out-of-state retailer otherwise known as a true retailer holds a permit and it issues the drop shipper any resale certificate for the. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Sales Tax by State.

A drop shipment is where a seller most times out of state sells a product which is then delivered to a consumer by a third party shipper. Delaware collects a gross receipts tax from businesses which can equal up to 207. Because that particular online store does not have an actual physical presence within your state it does not need to charge you sales tax.

Printful charges sales tax in 45 states. By Jennifer Dunn February 13 2018. If the shipping charge is not stated separately then it is considered to be a part of the taxable transaction and the seller is required to collect sales tax.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. One other thing to consider is that many states also require sales tax to be charged on shipping and delivery costs. This is a highly controversial practice that will probably be legislated in the future as many brick and mortar stores that do not have online counterparts are losing sales to the tax-free internet shops.

In states with no marketplace facilitator law like Florida or Missouri sellers with sales tax nexus an obligation to collect sales tax are still required to collect sales tax from buyers via eBay. Many states have exemptions from specific tax items. In most instances drop shipments in Minnesota are.

Such as a property in or around Jackson Hole. The following five states do not collect a state sales tax. Generally a Buyer must be registered as a retailer for salesuse tax in states where the Buyer has salesuse tax nexus.

The state of California does not usually allow any seller who legally has tax nexus to accept any sort of resale exemption from a customer who does not have tax nexus in a situation where the seller drop ships a property to any in-state customer. However some of these states find ways to collect taxes in other forms. In those states it is still down to the seller to set up their eBay account to charge sales tax to buyers to pay the correct amount to the state and to file returns.

These Wyoming state tax rules apply to commercial and residential property. The salesuse tax registration. As more and more of the world goes digital the question of whether or not to charge sales tax on digital products plagues more business owners.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Sales Tax Rates By City County 2022

Wyoming Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Is Shipping Taxable In Wyoming Taxjar Blog

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

These Are The Best And Worst States For Taxes In 2019

Wyoming Wy State Income Tax Information

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Income Tax Calculator Smartasset

Www Mmfinancial Org Irs Paymentplan Installmentagreement Lander Wyoming Irs Taxes Debt Help Tax Debt

Cost Of Living In Wyoming For 2022 Taxes Housing More Upgraded Home

Sales Tax For Online Or Remote Vendors A Study In Complexity Wyoming Sbdc Network

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer